Get a free insurance quote

Maybe you do not know that...

how to get a free insurance quote.

There are many online services that allow you to do this.

One of the best sites, in my opinion, is this:

https://www.thegeneral.com/quote/

It is very important to have offers to compare. Only in this way can we find the best insurance at the lowest possible price.

So a site where you can get a free quote it's very helpful.

If you'd like more information regarding car insurance by how much you drive, see our low-mileage car insurance guide here.

how to get a free insurance quote.

There are many online services that allow you to do this.

One of the best sites, in my opinion, is this:

https://www.thegeneral.com/quote/

It is very important to have offers to compare. Only in this way can we find the best insurance at the lowest possible price.

So a site where you can get a free quote it's very helpful.

After finding your dream car, choosing the correct car insurance policy is a less exciting task. It’s often boring, inconvenient, and expensive, but in order to protect your investment and follow the rules of the road, it's a necessity. The good news is, getting cheap car insurance quotes doesn't need to be difficult — let's review some tips on how to find quotes and end up with an affordable insurance premium.

How to get free auto insurance quotes:

- What documents do I need to get a free car insurance quote?

- Do insurance quotes cost money?

- What actually goes into my premium?

- Best ways to save on car insurance

How to find free auto insurance quotes online

If you don’t want to spend your entire day dealing with car insurance companies, be sure you have the following information on hand to get an accurate quote.

- The driver's license and personal information of you and any other drivers on the policy: This includes date of birth, address, occupation, and marital status.

- Your car's Vehicle Identification Number (VIN): If you're getting a car insurance quote for a new car, reach out to the private seller or dealership to get the VIN. If you can't provide an exact VIN, you'll need to furnish the year, make, and model of the car to get a preliminary quote.

- Mileage

- Date of purchase

- Driving history: Your recent driving history — and that of any other driver on the policy — with accidents, citations, claims, and any completed driving courses.

- Insurance record: Some car insurance companies require six months to a year of continuous auto insurance prior to issuing you a policy. Ensure you can provide a brief history of your recent insurance background.

Are car insurance quotes free?

Many companies advertise free auto insurance quotes. Any car insurance quote you receive is and should be completely free. Insurance companies want to incentivize you to purchase a car insurance policy from them, so they’re not going to charge you for an upfront assessment (the quote). When shopping around for insurance, remember you can find free car insurance quotes from a variety of sources.

What goes into a car insurance quote?

It's important to understand the primary goal of an insurance company is to effectively predict risk and assign premiums based on the risk a particular driver may pose. Car insurance companies assess your entire driving profile to estimate this risk, including factors such as location, demographics, insurance history, driving record, and vehicle.

1. Where you live

Because most forms of insurance are regulated at the state level, state legislation influences car insurance premiums. For instance, in Michigan, a no-fault state, state law requires an unlimited amount of Personal Injury Protection coverage, a requirement that increases the cost of car insurance. Although each state legislates insurance differently, auto insurance prices may vary on a zip code-by-zip code basis. Below is an analysis of the cheapest and most expensive states for car insurance (from The Zebra's State of Insurance report).

Whether you can get a cheap car insurance quote may come down to your zip code. If you live in a densely populated area, with a high number of auto insurance claims, your premium will be more expensive than that of a person living in a less dense and less claim-laden part of town. Even if you haven’t filed any claims, you could pay more based solely on your neighborhood.

Whether you can get a cheap car insurance quote may come down to your zip code. If you live in a densely populated area, with a high number of auto insurance claims, your premium will be more expensive than that of a person living in a less dense and less claim-laden part of town. Even if you haven’t filed any claims, you could pay more based solely on your neighborhood.

2. Who you are

"Who you are" is a pretty broad way to talk about the kind of risk you represent to an insurance company. Every company takes different factors into consideration, including the below:

How gender affects car insurance quotes

Unless you’re a teen driver, your gender isn’t a significant auto insurance rating factor. In fact, the national difference between car insurance premiums paid by women and men is less than 1%. For teenagers, this premium difference is much more dramatic: male teen drivers pay nearly $600 more per year than do female teens. Again, this comes back to the main goal of an insurance company – anticipating and limiting exposure to risk. Car insurance companies' historical data says young male drivers are more likely to take risks while driving than are female drivers in the same age group.

AVERAGE CAR INSURANCE COSTS BY GENDER

Age

|

Male

|

Female

|

16

|

$2,794

|

$2,440

|

17

|

$2,645

|

$2,325

|

18

|

$2,449

|

$2,180

|

19

|

$2,154

|

$1,191

|

How age influences auto insurance rates

Your age helps to determine your car insurance premium. Statistically, a young driver is less experienced and more likely to receive a citation or cause an accident. In the eyes of an insurance company, that means more risk and a greater need for financial protection, i.e., a higher premium.

Your likelihood of getting cheap auto insurance quotes increases once you turn 19, and again at 25, as you become less likely to drive recklessly. This remains consistent until you get into your 60s, when rates start to tick up again.

How marital status affects car insurance quotes

While the difference is small, married drivers are more likely to get affordable car insurance quotes than single, divorced, or widowed drivers. Car insurance companies see married drivers as more likely to share driving responsibilities and less likely to file claims.

For more information related to how your marital status affects how much you pay for your insurance policy, see our here.

How homeowner status changes car insurance costs

On average, renters face higher car insurance premiums than do condo or homeowners— by about $82 per 6-months compared to a homeowner. Homeowners are considered more financially stable and less likely to file a claim.

For more information regarding renters, condo, and home insurance, see our guides below:

How education affects auto insurance quotes

Although it’s not impactful, drivers with a Masters or Ph.D. save $20 per year on car insurance premiums, compared to those without a degree. Car insurance companies see clients with higher education levels as less risky and reward that decreased risk with a lower premium. The only states that do not consider education when determining rates are California, Massachusetts, Georgia, Hawaii, and Montana.

| PHD |

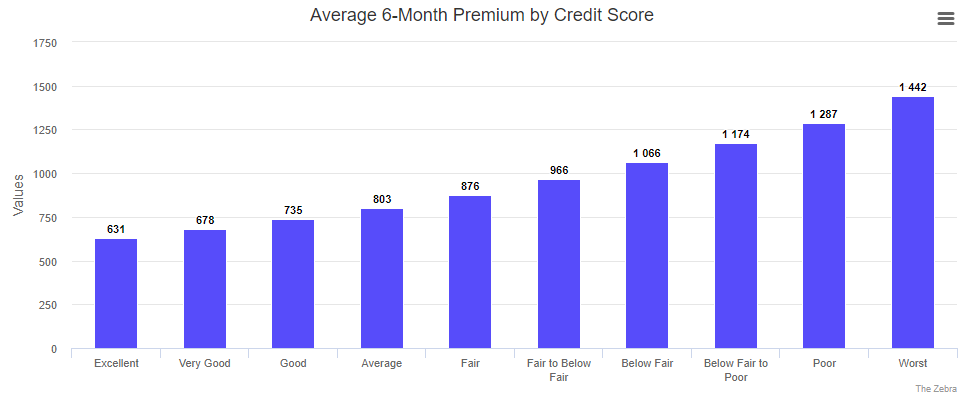

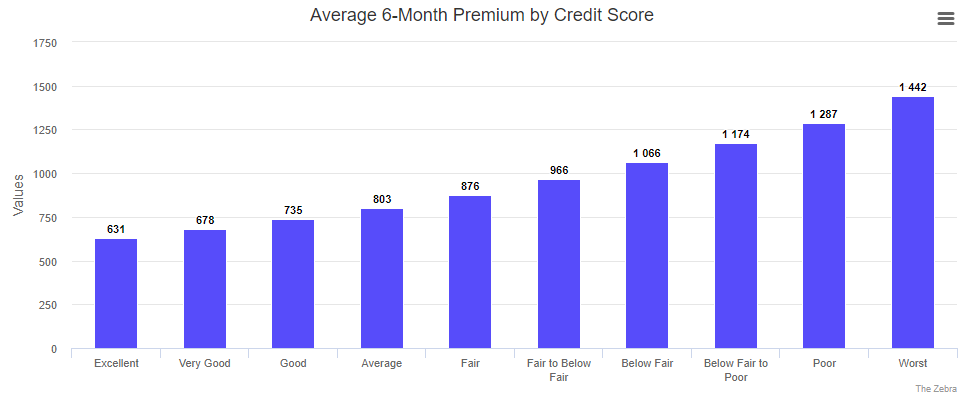

How credit score impacts car insurance premiums

Unlike your education level or gender, your credit has a big impact on your insurance rate. Drivers within the "worst" credit tier pay more than twice what those with excellent credit pay for auto insurance - about $811 for a 6-month policy. Again, this has to do with how insurance companies view drivers with poor credit in terms of risk. A driver with poor credit is more likely to file a claim than a driver with excellent credit. Moreover, when a claim is filed by a driver with poor credit, the claim payout by the insurance company tends to be higher. Insurance companies cover this risk by charging those with poor credit scores higher rates.

California, Hawaii, and Massachusetts are the only states that do not allow your credit score to be utilized in your car insurance quote. Outside of this, you can find lower car insurance premiums by looking at usage-based programs. UBI, backed by telematics, use the way you drive in order to determine your premium. See our article here for more information.

3. Your insurance history

It’s important to consider how your previous auto insurance record reflects on your car insurance quotes. Gaps in insurance — or periods spent with bare minimum coverage — can increase your quote, as insurance companies see you as financially unstable and more risky to insure. A lengthy insurance history with high limits and fewer claims can lead to cheap car insurance quotes.

4. How you drive

An insurance company's assessment of how you drive entails more than you might think. When assigning a quote, an auto insurance company will look at the primary way you use your vehicle, how many miles you drive annually, and your driving record.

Primary vehicle use and car insurance quotes

How you use your vehicle can impact the affordability of car insurance quotes. Using your vehicle for pleasure — the most common usage — results in an average premium of $735.

AVERAGE 6-MONTH CAR INSURANCE PREMIUM BY VEHICLE USE

It’s important to consider the difference between a business-use personal policy, outlined above, and a commercial car insurance policy. If you’re using your vehicle to transport goods or lending your vehicle to employees, you may need a commercial insurance policy.

If you’re a rideshare driver working for Uber or Lyft, consult your insurance company about getting a Rideshare Endorsement. This endorsement protects you from getting denied coverage if you’re in an accident while working.

How annual mileage affects car insurance quotes

How much you drive reflects how much risk you represent to your insurance company. If you live in California, your annual mileage makes a big difference. There is a 26% difference between those who drive 0-7.5k miles per year and those who drive 15k+ per year. This amounts to around $218 per year.

If you live anywhere else in the US, mileage may have less of an impact, but it isn’t ignored altogether.

If you'd like more information regarding car insurance by how much you drive, see our low-mileage car insurance guide here.

Violations: how driving safety impacts auto insurance quotes

Among the factors that go into car insurance quotes, driving history is probably the most significant. How youhavedriven is a good indicator of how youwilldrive. If your driving résumé includes speeding tickets, at-fault accidents, or other violations, expect your premium to reflect that. In other words, you're going to pay a lot.

Speeding tickets, DUIs, and other violations will make it tough to get cheap car insurance quotes. A DUI may raise your rate by as much as 80% — with some states penalizing drivers by more.

Depending on the specific violation and your state, the number of years these violations will remain on your premium can vary. Most companies will charge you for an at-fault accident for 3-5 years. However, a DUI can last as long as 10 years. For more information on finding car insurance with a bad driving record, see our guide here.

5. What you drive

The car your drive makes a big difference in your insurance rate. Vehicles built for performance, with high MSRP (manufacturer's suggested retail price), and foreign-built models are often costlier to insure. Vehicles that don't cost as much to repair or aren't built for faster driving — such as vans and sedans — are correspondingly cheaper to insure.

| Truck | $811 |

| Van | $829 |

| SUV | $901 |

| Car | $1,058 |

| Luxury | $976 |

| Green | $1,008 |

How to get a cheap car insurance quote and keep your rates low

Now that we’ve outlined why insurance can cost so much, let’s look at some ways to save.

Be smart with your claims

At-fault accidents can lead to inflated insurance rates. If you’re not familiar with the way insurance companies price policies, you might be inclined to use your collision coverage if you’ve damaged your vehicle. But unless you’ve done significant damage, it may be worth paying for damages yourself and declining to involve your insurance company.

Should you file a claim? Take the below steps and assess:

- Get an estimate for the repairs at a local mechanic

- Use The Zebra's State of Insurance analysis to determine what the average premium increase would be if you were to file a claim in your state. Remember: this compounds over three years.

- Compare the cost of repairs to the total rate of increase plus your deductible to the total cost of repairs.

If you're unsure of whether or not to file a claim, see our guide here.

Be smart with your coverage

Unlike your home, your vehicle will rapidly depreciate in value, meaning the coverage you once had might not be necessary after a few years. For example, collision and comprehensive coverage are designed to protect your vehicle from damage. But if your vehicle is worth less than $4,000, the value of insurance payout you would receive may not justify the cost of your insurance premium.

When shopping for affordable car insurance quotes, come in with a good idea of your vehicle's value via Kelley Blue Book and NADA. If you determine your vehicle is worth more than $4,000 but you need to save money, consider raising your deductible. Because your car insurance deductible and premium are inversely related, you can lower your bill by raising your deductible. Looking at the chart below, you can see how your premium is affected by adjusting your deductible.

For more information on car insurance coverage options, see our related articles below.

- Car insurance with a $500 deductible

- Car Insurance with a $1000 deductible

- State minimum vs full coverage

Look for discounts

Some car insurance discounts are automatically added to your auto insurance policy when they pull your driving report. But, you will want to make sure they’re not forgetting anything. Here are some potential discounts and cost-cutting programs you can participate in. Certain restrictions apply, of course.

- Multi-policy discount

- Good driver discount

- Good student discount (ages 16-25)

- Good/safe teen driving discount (pre-approved safety training course)

- Telematics

- Payment by bank account

- Paid in full discount

- eSignature discounts

- Paperless billing discount

- Multi-vehicle discount

- Safe driving senior discount

- Multi-driver discount

Shop around for insurance quotes

Your auto insurance quotes can vary based on your circumstances. You should shop around for new car insurance quotes as often as possible! For the most part, car insurance policies are non-binding. If you find a better rate elsewhere, cancel your current policy and move on to the next. The remaining outstanding premium should be refunded back to you. Opportunities to look for cheaper rates include when you move, when you add or change a car to your policy, get married, or celebrate a birthday.

Getting cheap car insurance quotes: primary takeaways

Auto insurance companies attempt to predict and price the risk you and your vehicle pose in order to reduce their exposure. Keeping in mind the factors we just covered, the riskier you appear to your insurance company, the more you will be charged. Factors like age, marital status, and homeowner status, are less easy to change. Avoiding unnecessary claims, being smart with your coverage needs, and shopping around for car insurance quotes every so often are great ways to save on car insurance.

For the methodology regarding our state, see our 2019 State of Insurance Analysis.